decoding cryptocurrency, capitalization and metadata rates: guide for beginners

The world of cryptocurrencies is a complex and rapidly developing field, with many terms that may not be known to new investors or users. In this article, we will delve into three key concepts in the cryptographic space: fees, capitalization and metadata.

cryptocurrency indicators

Cryptocurrency indicators apply to costs associated with the use of cryptocurrencies for transactions. These rates are usually calculated for stock exchanges, payment processors and other intermediaries that facilitate blockchain transactions. The stake structure may differ significantly between different cryptocurrency platforms, and some charge a fixed fee or others have obtained the percentage of transaction value.

For example, bitcoin transactions were historically relatively low, and the rates ranged from 0.0003 to 1.5 cents per bajt. However, other cryptocurrencies, such as Ethereum and Litecoin, usually take higher rates due to their faster blocks and increase network embolism.

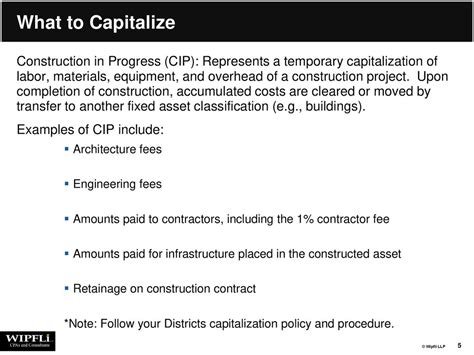

Capitalization

Capitalization refers to the total value of the cryptocurrency offer. It includes all available currencies, systems or other forms of digital assets that are issued by a specific project or entity. Capitalization is usually measured in terms of price for currency, with higher prices indicate stronger demand and greater capitalization.

Some unusual examples of high capitalization cryptocurrencies include bitcoins (BTC) with a market value above 1 trillion USD, Ethereum (ETH) with a market value above USD 500 billion USD and Cardano (ADA) with the border market of approximately USD 5 billion. Because the value of these assets changes, their capitalization may change properly.

metadata

Methadates refer to non -transaction data related to cryptocurrency transactions, such as blockchain addresses, transaction abbreviations and other details about the basic network. Methadates play a key role in maintaining blockchain integrity and safety, because it enables efficient storage, recovery and verification of transactions.

Some typical examples of metadata include:

- Blockchain addresses: These are unique codes that identify specific transactions in blockchain.

- Transaction hash: These are digital fingerprints of individual transactions, usually used to verify authenticity.

- Network topology metadata: contains information about the structure of the network and system, such as blocks and transaction speeds.

Methadates are necessary for the creation of solid and sclable blockchain. Carefully managing these data, developers can create more efficient, safe and friendly platforms that use the power of cryptocurrency and blockchain.

Application

Cryptocurrency, capitalization and metadata indicators are important elements of the encryption ecosystem, each plays a key role in creating values and adopting various assets. Understanding these concepts and their interactions users, investors and programmers can create more conscious and effective strategies of moving in this complex and rapidly developing space.

We hope that this article has presented a useful introduction to these concepts, preparing the script for additional exploration and analysis of the cryptocurrency world.